OKX Fraud Risk Case Management

How can we improve agent’s average handing time and reduce in scams at the same time. An overall rehaul to scam report flow to one that more efficient.

What was my role?

One of Compliance’s PD, taking on specifically Internal Ops Tool (Case Management) section:

Designed User Scam Report Channel + Graph Investigation Tool

Completely new UI interface

User (Ops) feedbacks and iterations

Proposed design-led improvements

Scaling template for other requirements such as Worldcheck Case Management

The goal is to design tools to help identify the single bad user responsible for multiple fraud cases

Some fraud examples:

Fake payment proof: Fraudsters send fake payment screenshots to sellers in P2P.

Scams: Users are lured into sending funds to “investment advisors” or fake “OKX affiliates.”

Account takeover: Phishing attacks targeting SMS/WhatsApp/WeChat users.

Money Laundering: Cross-border syndicates using OKX P2P to convert illicit funds. Cross-border money mules, smurfing

These new tools can increase speed to resolve Fraud Risk

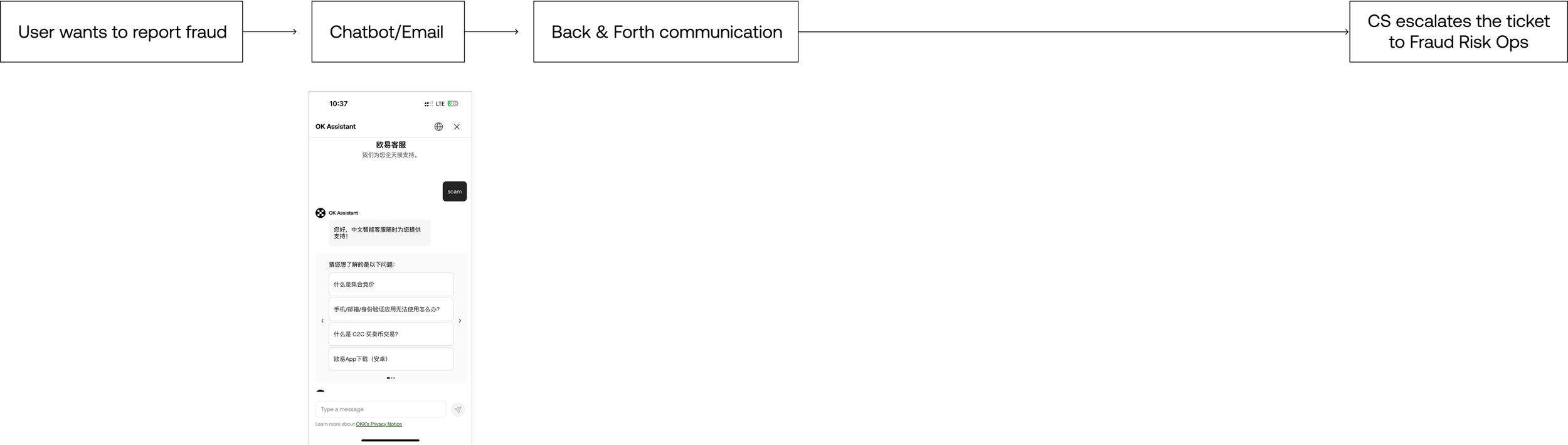

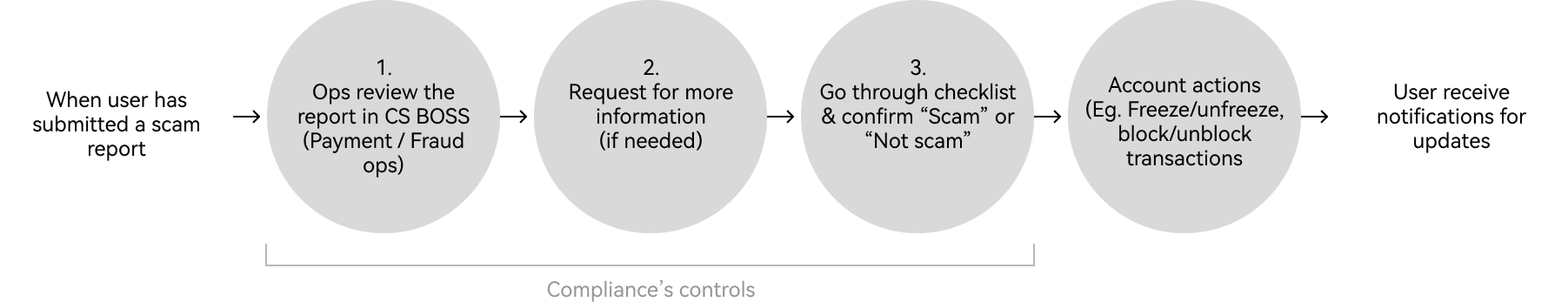

Existing flow

Proposed

Impact: User can get report more easily and Ops can make decision quickly because information retrieved is upfront.

Currently Fraud Risk Ops & Payment Risk Ops uses Email to communicate with users. The process is long and inefficient. And there are no system ticket to track the ops performance

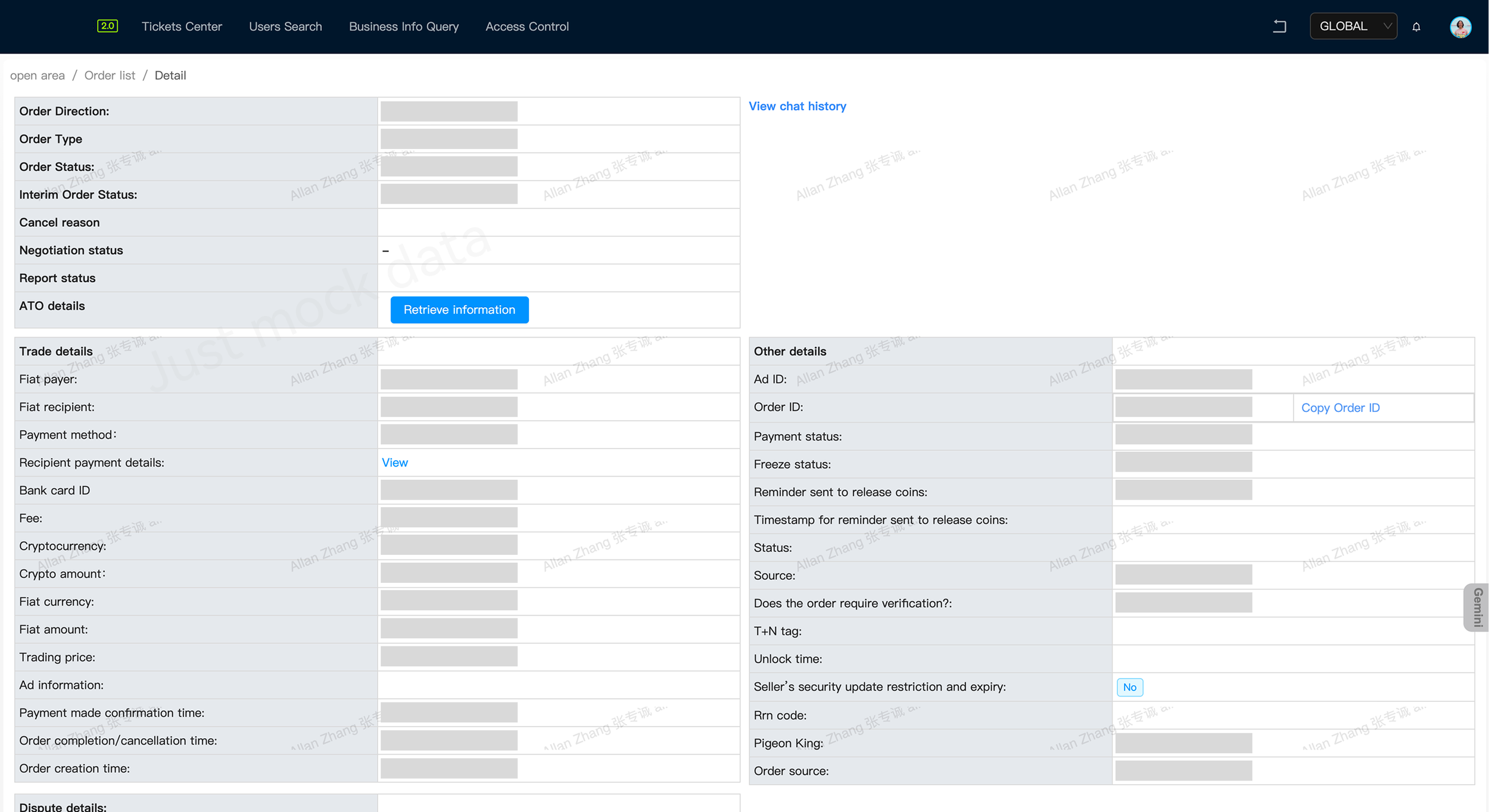

Before

Not only because of the backdated UI, the information also does not have a clear hierarchy for Ops team to be able to sieve out the most important data points.

After

What I have did differently (below) is to:

Revise UI to latest internal system design system • Provide information categorization and hierarchy • Collection of scam reports • (Kindly note that user data below purely just mocked data)

Other sections

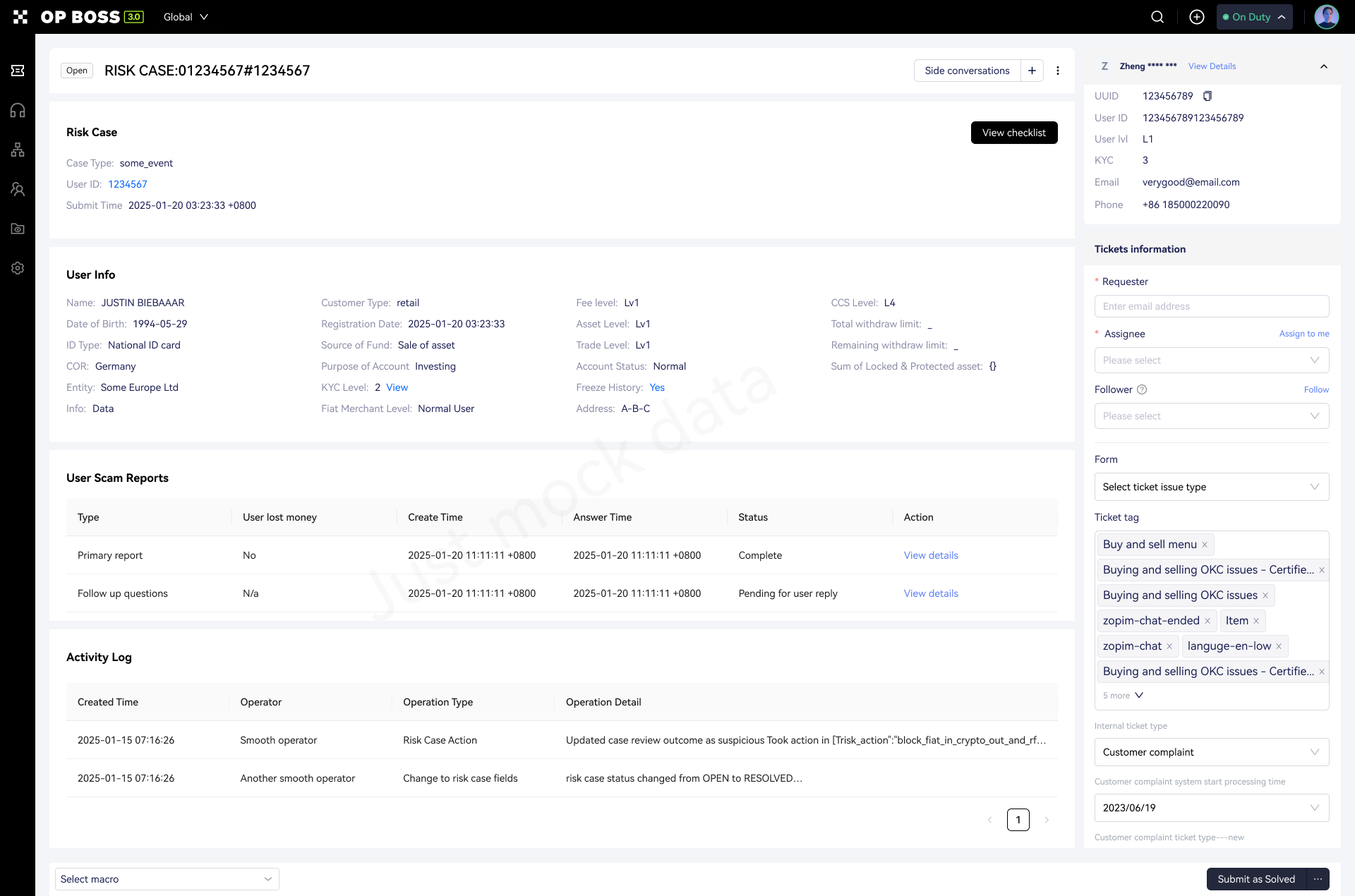

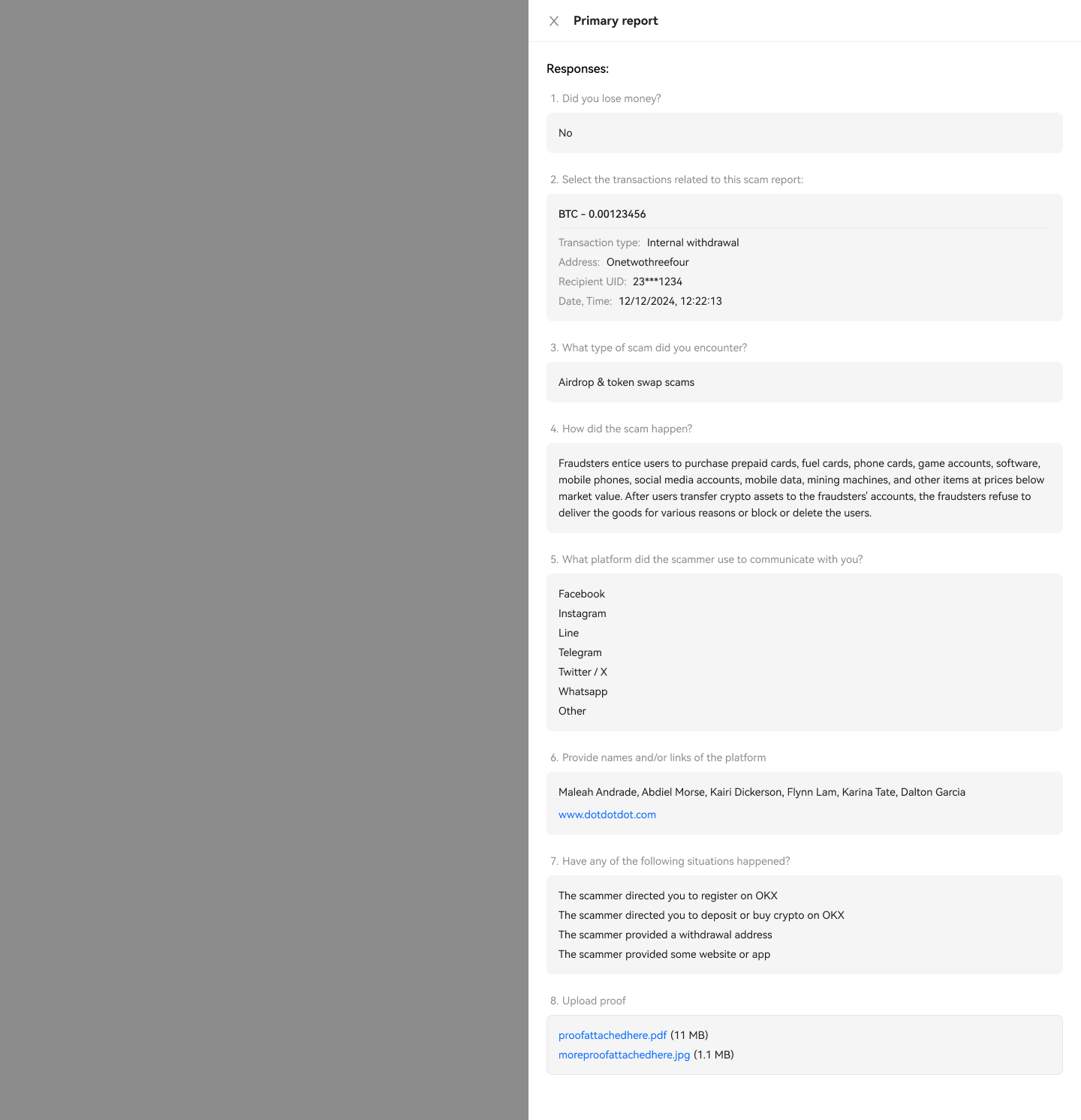

1. Report details view

The reported information by user will be shown here for detailed evaluation.

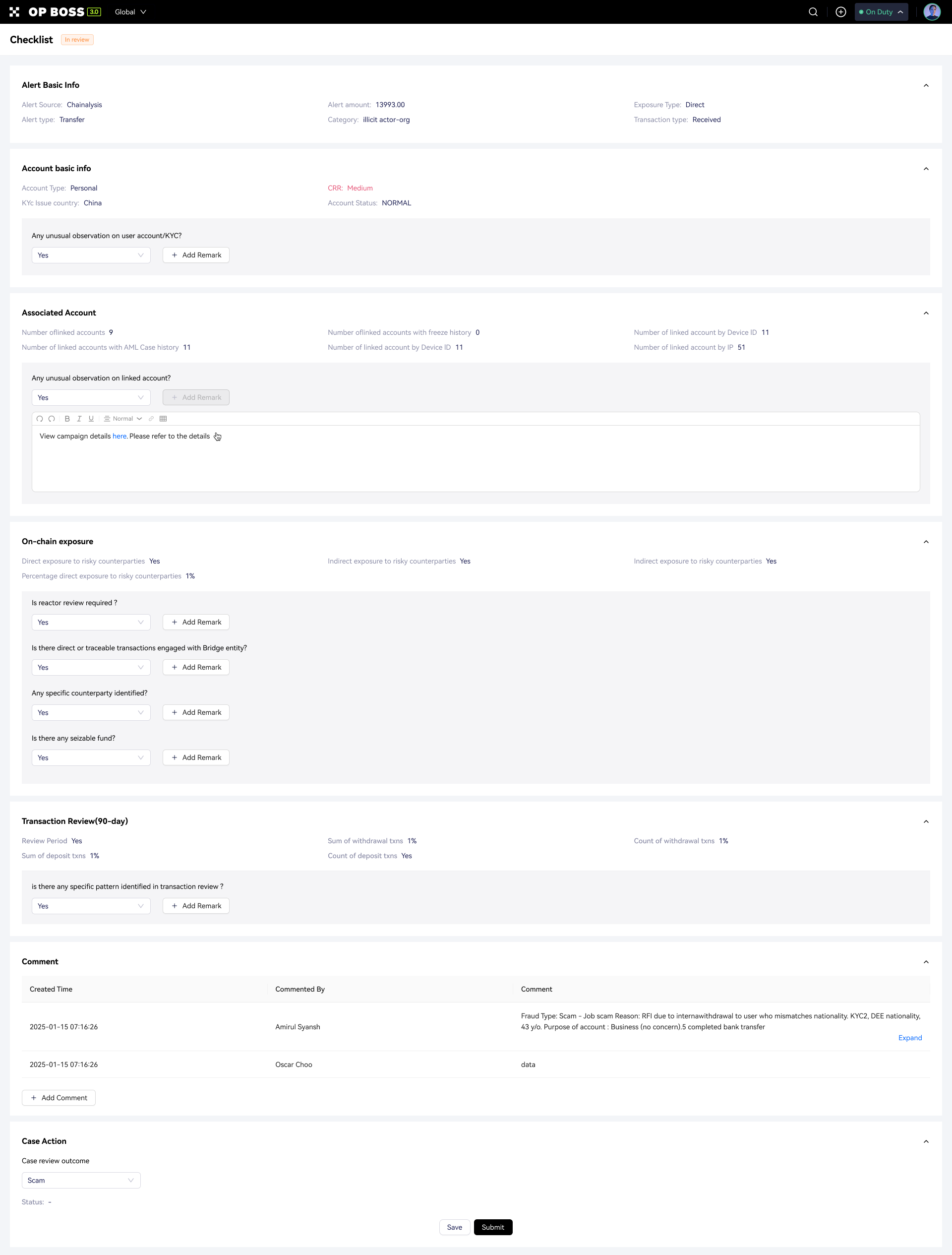

3. Checklist page

A step-by-step review checklist to standardise the metrics and evaluate whether the reported user is scam or not. Here ops can make decision whether user is scam or not.

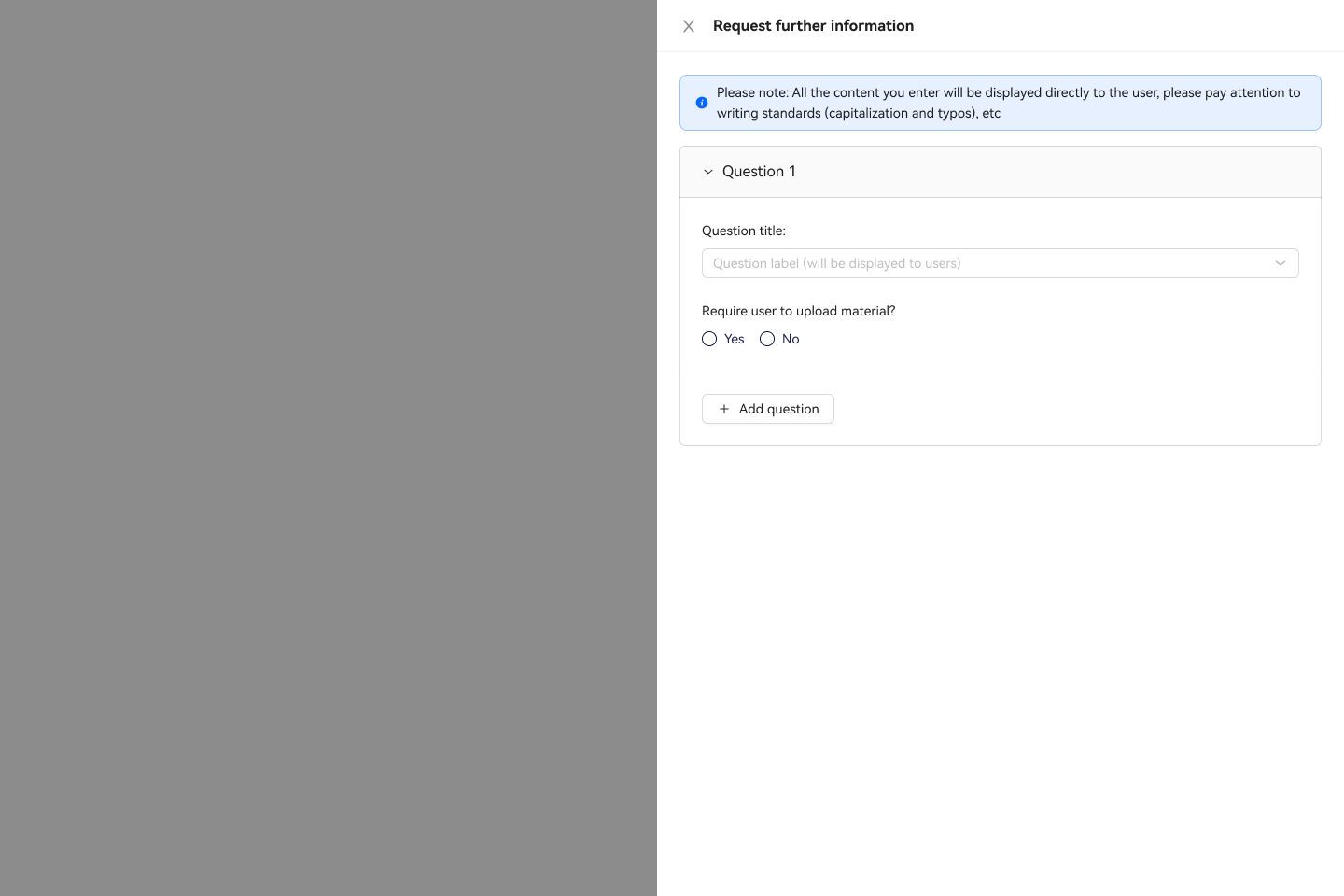

2. Request for further information

When Ops feel there are additional information requirements, Ops may want to request information from our customer. Therefore this page acts like a like Mini-CMS. Personalised questionnaire to give a better experience for our customers.

User feedbacks

Based upon user feedbacks via them trying out a pre-launch. Beyond bugs, there are…

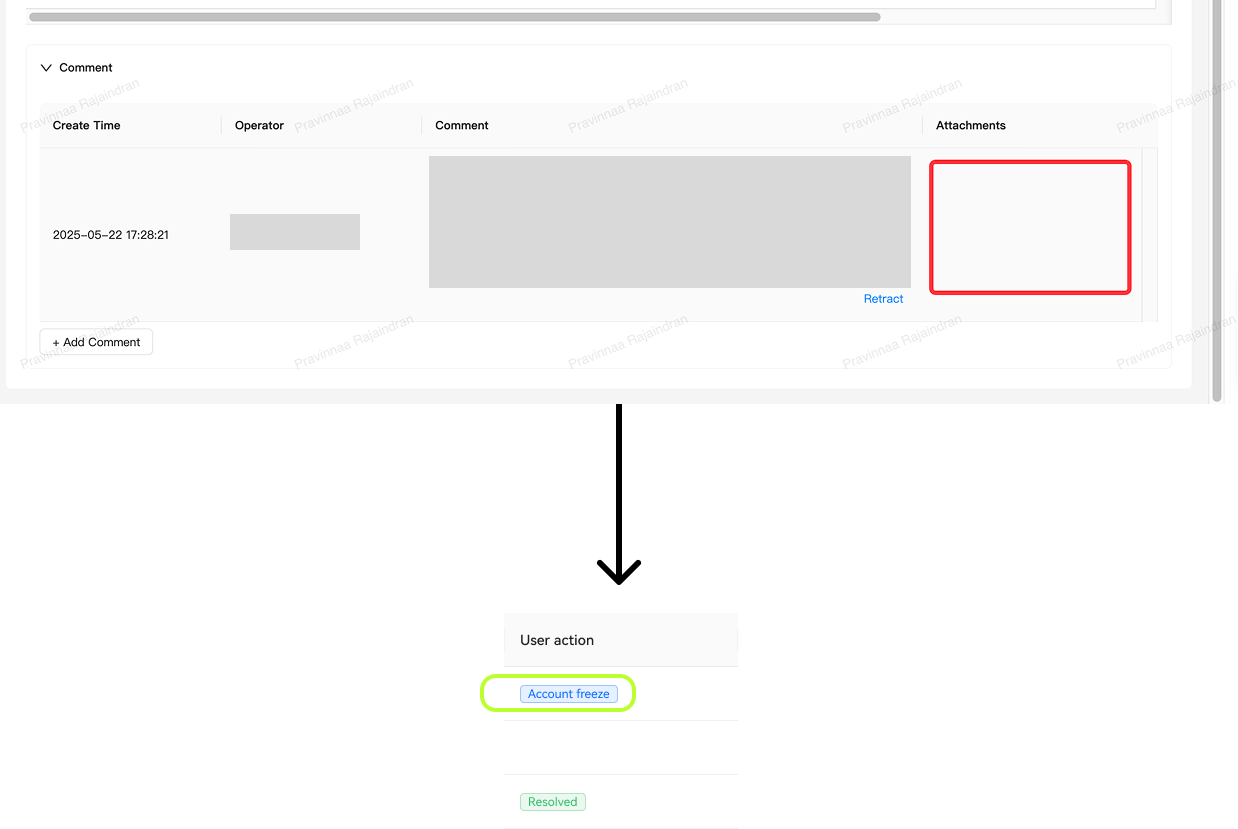

Suggestion

A column indicating the case decision and freeze action on the user account.

Feedback on existing feature

The transaction activity data is in black and white (unable to differentiate on the red flag)

Design-led initiatives

Table alternative template

Issue:

The use of table format has limitation:

Limited space per field: Can’t show long text or complex details without truncation or tooltips.

Less visually distinct per row: User may overlook status or details when rows look uniform.

Benefits:

Visually scannable: Each report is clearly separated and easy to read.

Content-rich: Can include longer descriptions, metadata, and actions (e.g., “View details”).

Good for low-volume data: Ideal when there are just a few items to display.

Collapsible “check” enabled checklist

Issue:

No Clear Sense of Progress

Users can't tell which sections are done, in progress, or still missing.

There’s no visual feedback (like checkmarks, progress bars, or section status).

Users are exposed to everything at once even if they only need to focus on one section at a time.

Higher chance of making errors

Users are exposed to everything at once even if they only need to focus on one section at a time.

Higher chance of making errors

Enhanced benefits:

Collapsible - Make the checklist more manageable, scalable, and action-oriented for analysts or reviewers.

Reduce cognitive overload while improving progress tracking.

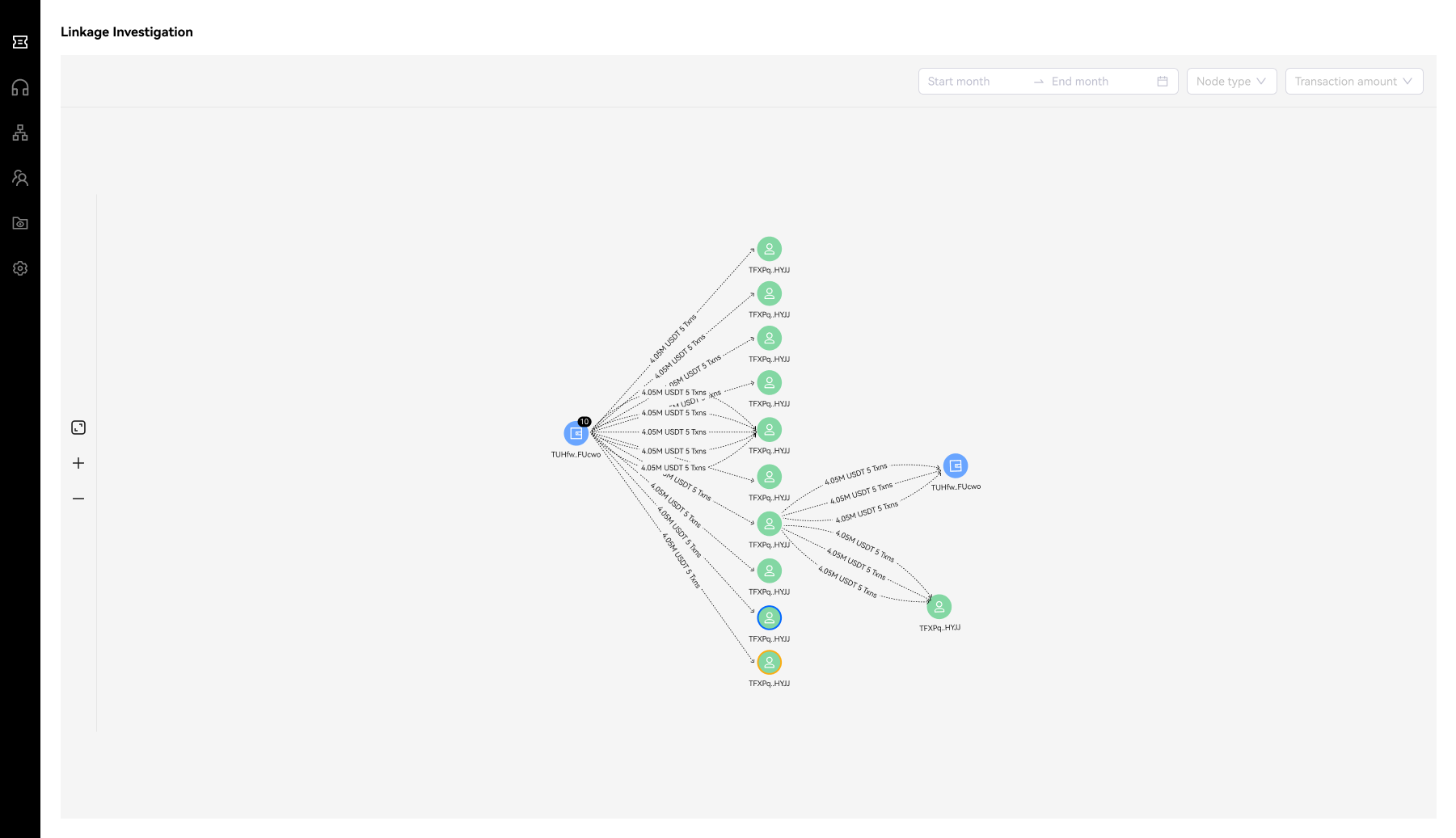

Graph investigation tool

Background (on the left)

As of today, we do not have any internal tools available that allow the ops team to quickly visualize the linkage network between different accounts.

The current investigation workflow is scattered on different pages in the BOSS system. Ops teams are unable to effectively identify related parties and their risk info. The closest way for ops to review linked accounts is to search by device id one by one to find any associated account.

Solution (Below)

In order to bridge the gaps, we aim to provide a powerful network graph investigation tool for teams to boost their efficiency.

Success

4.2 days

The payment risk team was able to bring down their average handling time of 11.7 days to 7.5 days. That’s time saving of 35% for each investigation case.

10+ minutes saved

From an average time per user takes to send information to operations team drop from 15.1minutes to 5.4minutes. Thats 3X the time saved.

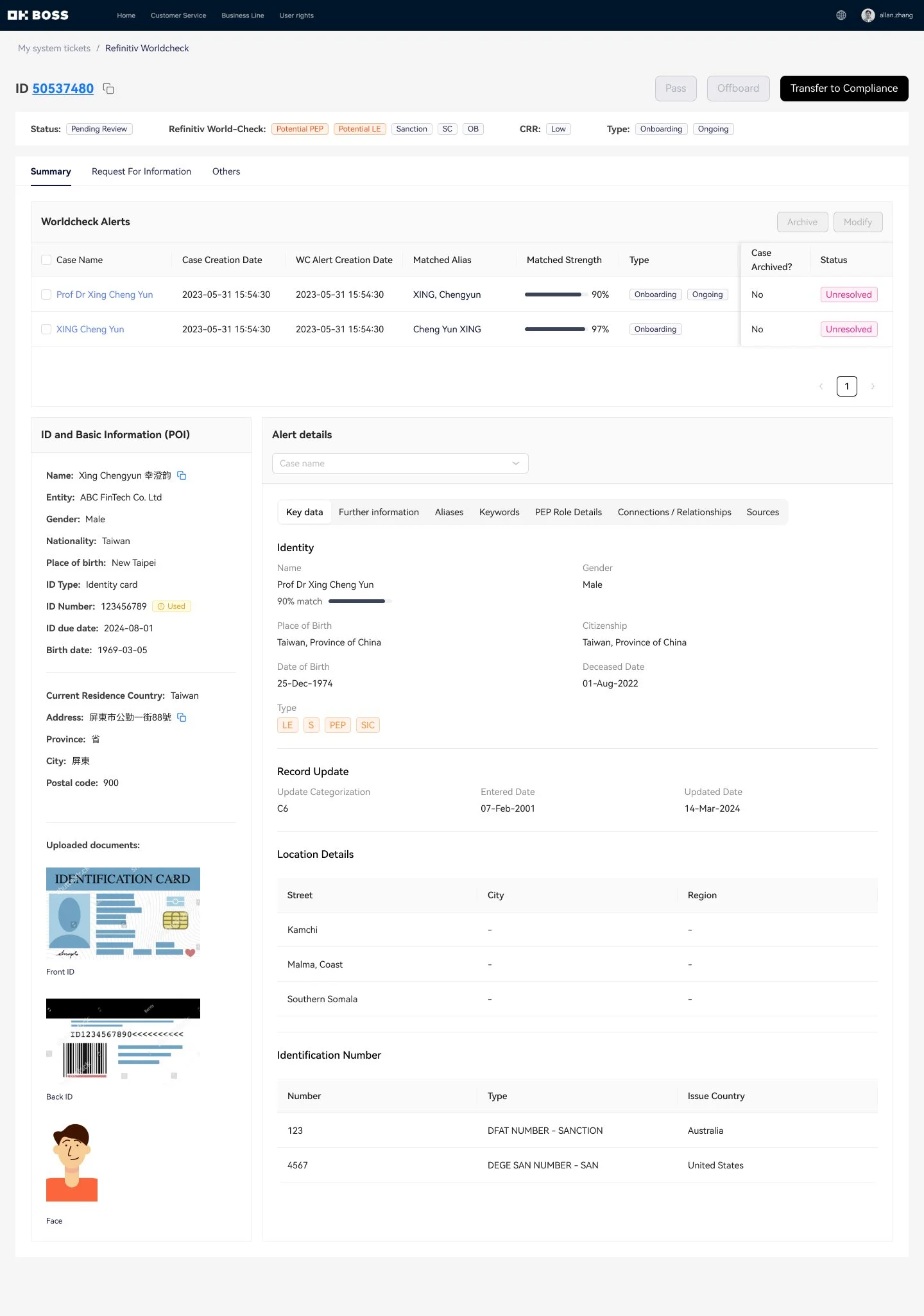

Design that scales

“Worldcheck” Operational Panel 2.0

Display all relevant information from Worldcheck to enable agent to review all at once

Build proper functionality on BOSS to allow agents to resolve alerts based on specific alert types (e.g., True PEP, True LE).

Ensure that true matches, false matches, and possible matches are categorized and recorded accurately for each alert type.

Enable auditors to easily extract and analyze data through standardized reporting.